Practical Application of a Multi-Vertical Strategy in e-Commerce

by Jan Riehle

Find below a link to an article about the implementation of a Multi-Vertical Strategy in e-Commerce written published on the web-portal of Ecommerce Brasil in May 2017:

Please find the English version of the Article below:

Practical Application of a Multi-Vertical Strategy in e-Commerce

Buyer fidelization has proven to be a serious challenge for e-commerce companies all over the world. Clients tend not to be loyal to online-store brands and repeat their comparison- and selection-process for every new purchase. Potential solutions like rewarding repeated-buying behaviour with customer-clubs and similar do provide help, but in most cases they are not sufficient to solve the problem.

An alternative strategy is to build a multi-vertical strategy in online-retailing, in which basically “all roads lead to Rome” (meaning, all customer clicks lead to the same retailer’s online store verticals), without the customer necessarily being aware of the fact that he is buying from the same company independent of the site he acquires the product at.

The current crisis and resulting consolidation process e-commerce in Brazil is currently undergoing seems to provide an interesting foundation for the application of such an approach, either by simply buying competitive verticals and adding them to an existing portfolio, or by launching new verticals from scratch. Whereas the later approach can be very time-consuming and costly, the approach of diversifying channels through acquisitions is a trend that can be observed in various acquisitions within the Brazilian E-Commerce Marketplace in 2015 and 2016, and this trend is likely to continue in 2017 as the crisis still does allow for economic acquisitions.

Three examples of such recent consolidation activities which include application of the above strategy are: Online retailing of optical products, with French Optics Holding Essilor acquiring eOtica.com.br, e-lens.com.br as well as lema21.com.br (through eOtica) bebestore.com.br acquiring baby.com.br and both continuing operations as independent end-customer verticals; Grupo Cantu acquiring itaro.com.br and pneusfacil.com.br, and operating them together with their existing vertical PneuStore.com.br

This article is explaining a process for the implementation of such a multi-vertical strategy developed by the author in the positioning process for Pneustore/Grupo Cantu during the acquisition of Itaro.

The perspective a retailer should take when applying the multi-vertical strategy should be: “How do I make sure that whatever potential search my clients do they go they will end up buying the product in one of my stores?”

The challenge is to make sure that - instead of having your channels compete with each other - commercial conditions, communication and perceived value proposition complement each other.

Ideally, the process of determining the optimal channel-positioning includes all of the following steps in the following order:

Segment your existing Customer Base

Normalize the data structure for the client-bases over all verticals to make sure you work with the same attributes per vertical

examples of common attributes are: age, income, geography, experience with product category, price sensitivity, frequency of online usage, etc.

If the existing data is not sufficient in one or more of the vertical’s CRM systems, actively enrich the data via customer surveys

Do a regression analyses over the global dataset to find similarities per vertical

Develop a subset of simplified customer models, representing at least 85% of the overall client base per vertical

= > The result defines your base for a generic customer type per vertical

Map out a Customer Decision Tree

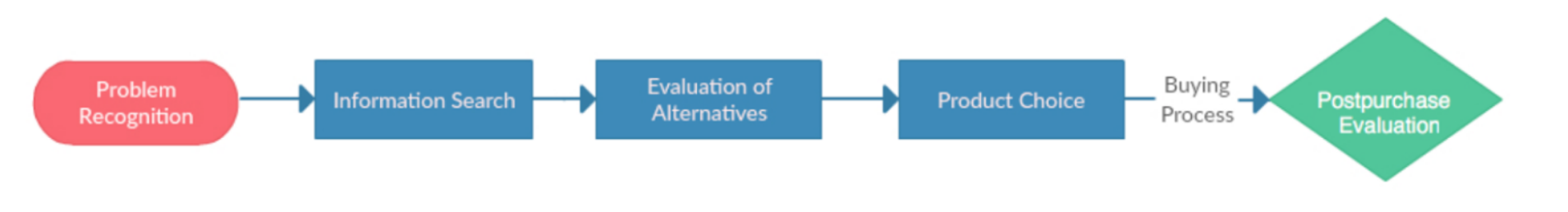

Map a simplified generic customer decision tree for your sector. Create customized decision trees for each of the generic customer models identified above

An example for such a customer decision tree could include the following steps:

Map your Vertical’s Competitive Environment

Map your own and your competitor’s verticals against each other, use the attributes you qualified for your generic customer profiles

Connect the Decision Tree and the Competitive Environment

Verify connections between your competitor’s verticals and your generic customer profiles

Use this step to return to step 1 and add customer profiles which your verticals might not serve yet. Repeat this until you have developed a deeper understanding of the overall market.

Configure your Verticals

Once you have a complete picture of the competitive environment, re-configure step by step your vertical’s attributes in the following areas:

- Commercial Attributes

- Assortment Strategy

- Brand and Communicational Aspects

Verification of Results and if Iteration

Update the competitive Environment Map based on your new Vertical Configuration

Verify the Customer Decision Tree: Is the maximum number of clients being directed to your stores? Is there more optimization potential to gain additional market share?

No => You are done!

Yes => Redo steps 2 to 5 in order to maximize your potential

An incomplete process, or an approach in which the above steps are been taken in the wrong order, but also a lack of necessary iteration of the process is likely lead to a suboptimal positioning of the different ecommerce verticals, and thus result in those vertical competing with each other instead of complementing each other to dominate the market.

After implementation, it is advisable to go through the entire process in a defined period, for example all three months in order to a) include learnings and b) adopt to a constantly changing competitive environment.

Subscribe via RSS